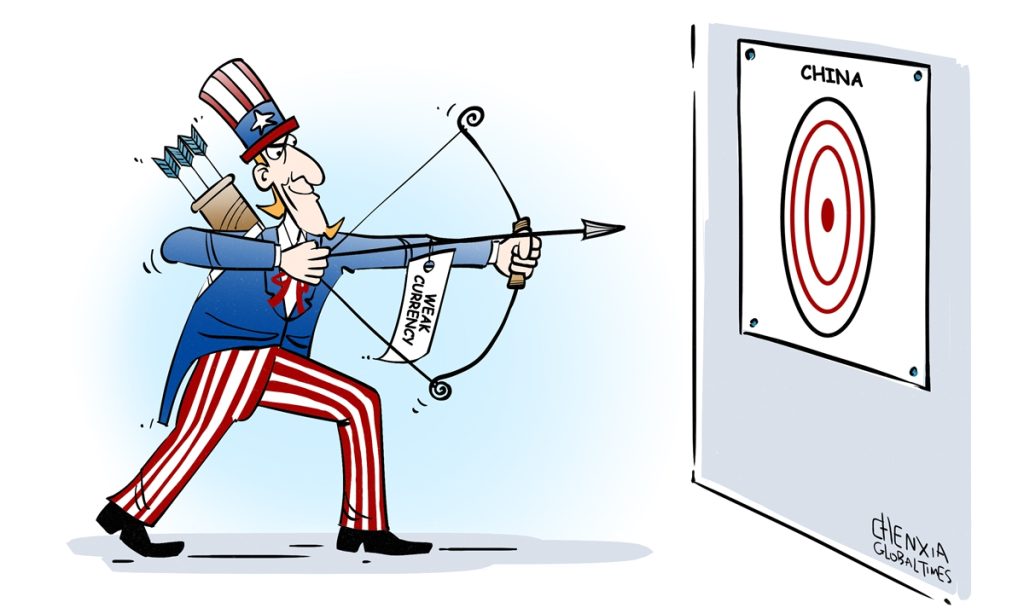

‘Overcapacity’ and ‘weak currency’ are latest US excuses to suppress Chinese exports

In addition to the groundless hype about "overcapacity" regarding exports of China's new-energy products, some Westerners are turning their attention back to China's currency and its depreciation pressure, trying to combine these two things as an excuse for US protectionism to suppress China's exports.

The Wall Street Journal published an article on Saturday, attributing China's export boom to not only "bulging industrial capacity" but also the "lower exchange rate" of China's currency. This ridiculous logic reflects how some American elites have become increasingly hysterical and unscrupulous in their campaign to suppress Chinese enterprises and embrace trade protectionism.

The yuan exchange rate has long been a sensitive issue in China-US relations. Elites in Washington were once enthusiastic about persuading the US government to declare China "a currency manipulator." Currently, although there is no evidence to suggest that discussion of currency manipulation is emerging, media hype about the depreciation of the yuan hasn't stopped, reflecting the strong inertia of a narrow-minded and outdated mentality.

The central parity rate of the yuan strengthened 69 pips to 7.0994 against the US dollar on Monday, according to the China Foreign Exchange Trade System. The yuan has depreciated since the beginning of this year, when the rate stood at 7.0770 on January 2, but a slight depreciation is normal and won't have much effect on the economy.

Many Asian currencies have been hit this year by the strength of the US dollar. The yen last week weakened to 160 against the US dollar, marking its lowest point since 1990. As multiple Asian currencies continue to depreciate against the US dollar, the yuan has maintained its resilience in the foreign exchange market.

The main reason for the depreciation of Asian currencies is the strength of the US dollar. Asia's central bankers are bracing for more turbulence as the receding prospect of US interest rate cuts in the near future sends shockwaves through regional currencies.

It's ironic that some American elites claim China's "weak currency" is turbocharging China's overseas sales at the expense of other exporting nations, but the fact is that it is the irresponsible US monetary policy that has resulted in Asian currencies' depreciation.

Amid economic uncertainty caused by sluggish global demand, an abnormal fall of a currency is one of the financial risks that will result in capital flight and erode social faith. Few analysts believe that Asian countries want to manipulate their currencies into a steep depreciation.

A weak currency contributes to higher exports, but if some Americans believe the depreciation of Asian currencies damages the interests of the US economy, then it is not Asia's exports that should be blamed, but the irresponsible US monetary policy.

The yuan's depreciation is mild compared with other major currencies in Asia. The yuan is likely to face renewed depreciation pressure if the US Federal Reserve continues with its irresponsible monetary policy, but China is fully capable of stabilizing the market and keeping the yuan steady at a reasonable and balanced level.

The resilience of China's currency is underpinned by the country's steady progress in economic development and expanded economic scale in the past several decades.

The US has been unreasonably hyping the false narrative of "overcapacity," and its real purpose is to attack the Chinese economy, especially its export sectors. Some observers believe the "overcapacity" rhetoric has replaced the "currency manipulation" hype as the latest excuse for US protectionism, but we probably face a more complex situation, as some American elites try to combine these two arguments to suppress China's exports.

It is easy to see through their tricks. We hope that the US can restrain the internal rise of trade protectionism and return to the track of free trade.